Selling a Car with Outstanding Finance: Essential Tips

Yes, you can absolutely sell a car with outstanding finance. It’s actually a really common situation here in the UK, so don't worry. The most important thing to get your head around is that even though you're the registered keeper on the V5C logbook, the finance company is the legal owner until every last penny is paid off.

This means you have to clear the remaining balance either before you sell or at the point of sale. Only then can you legally transfer ownership to the new buyer.

Understanding the Legal Bits of Your Financed Car

It’s a common misconception that you can just sell the car and carry on with the monthly payments. I’ve seen people try this, and it never ends well. Doing so is not only a major breach of your finance agreement, but it’s also illegal. Your finance deal is secured against the car itself, which gives the lender the right to repossess it if payments stop—even from a new owner who had no idea.

This is why the settlement figure is so critical. It’s the magic number you need to sort everything out.

The Role of the Settlement Figure

Think of the settlement figure as the key to a smooth, legal sale. It's the total amount you need to pay to clear your debt, which usually includes the remaining loan balance plus any interest or early repayment fees. Before you even think about putting an ad online, your first call should be to your finance provider to request this figure.

Knowing this number helps you in a few ways:

- Set a realistic price: You’ll know the absolute minimum you need from the sale to break even and clear the debt.

- Be upfront with buyers: Honesty is everything. Explaining that there's finance outstanding and how you'll clear it with the sale proceeds builds massive trust.

- Structure the deal: Whether you're selling privately or trading it in, the settlement figure dictates how the transaction will work.

Getting your settlement figure early on turns what seems like a complicated mess into a straightforward, manageable process. You’re in control, and there won’t be any nasty financial surprises later.

Registered Keeper vs. Legal Owner

This is where a lot of people get tripped up. The V5C logbook shows who is responsible for the car (taxing it, insuring it, dealing with speeding tickets)—that's the registered keeper. It does not prove legal ownership.

Until that finance agreement is fully settled, the car belongs to the finance company.

Trying to sell it without their knowledge is fraud, plain and simple. The buyer could lose their new car and their money when it gets repossessed, and you'd be in serious hot water. The only proper way to do it is to use the sale money to pay off the settlement figure, which transfers legal ownership to you, ready to be passed on to the new buyer.

Getting Your Settlement Figure and Understanding the Numbers

Before you even think about writing an advert or taking photos, your very first move is to get a crystal-clear picture of where you stand financially. This all starts by getting a settlement figure from your finance company. This isn't just a rough guess of what you've got left to pay; it’s the official, legally binding amount needed to clear the loan completely and take full ownership of the car.

Think of this number as your anchor for the whole process. It dictates the minimum price you can accept and gives you the confidence to negotiate properly because you know your bottom line.

How to Request Your Settlement Figure

Thankfully, getting this figure is usually a simple affair. The quickest way is often to log into your online portal with the lender or just pick up the phone and give them a call. Make sure you have your finance agreement number handy, as it'll speed things up. They're legally required to give you this information.

The figure they provide isn't just one number; it’s made up of a few different parts:

- The Remaining Loan Capital: This is the core amount of the original loan that's still outstanding.

- Accrued Interest: The interest that’s been added on since your last monthly payment went out.

- Early Repayment Charges: Some agreements have a small penalty for clearing the loan early, but this is often capped at one or two months' interest.

Your settlement figure is a live quote with an expiry date. It’s typically only valid for a set period, usually somewhere between 14 and 28 days. If you don't sell the car and clear the finance within that timeframe, you'll have to request a fresh one.

Understanding the Financial Landscape

If you're in this boat, you're certainly not alone. It’s incredibly common. Industry data suggests that a staggering 20-25% of all used cars on the market still have some form of finance attached to them. With the total value of car loans in the UK now topping £50 billion, it’s just a normal part of selling a car these days. You can dig into these trends in more detail by looking at UK Finance's research on consumer credit.

Knowing your settlement figure from the get-go helps you sidestep the biggest potential headache: negative equity. This is the tricky situation where you owe more on the finance than the car is actually worth. For instance, if your settlement figure is £12,000 but dealers are only offering £10,500 for your car, you're facing £1,500 of negative equity. You’ll have to find that shortfall yourself to clear the finance. Getting that number early means no nasty surprises and gives you time to figure out how you'll cover it.

Choosing Your Best Sales Route: Private vs Dealer

Okay, you've got your settlement figure. Now comes the big decision: how are you actually going to sell the car? When there’s finance involved, you've got two main routes, and they offer very different experiences when it comes to price, speed, and overall effort.

You can either roll up your sleeves and go for a private sale or take the simpler path and head to a dealership. There's no single "right" answer here—it all boils down to what you value most. Are you chasing the best possible price, or do you just want a quick, clean break?

The Private Sale Path

Let’s be honest: selling privately will almost always get you more money. You're in control, setting a price based on what the car is actually worth on the open market, not a dealer's trade-in estimate. That difference can easily be a few thousand pounds, which is a massive help if you're trying to clear negative equity.

But that extra cash comes at the cost of your own time and effort. You're the one handling everything from writing the ad and taking photos to arranging viewings and haggling over the price. The real hurdle, though, is managing the financial side. You have to convince a stranger to trust you with their money to pay off a loan on a car they don't yet own. It's a delicate dance that requires a lot of transparency.

The trickiest part of a private sale is timing the payment perfectly. You need the buyer's funds to clear the finance at the precise moment of sale so you can legally hand over the keys. This takes clear communication and a rock-solid plan.

Selling to a Dealership

The biggest draw of selling to a dealer or a major car-buying service is pure, simple convenience. These businesses handle cars with outstanding finance every single day. They have the process down to a fine art.

They'll value your car, confirm your settlement figure with the lender, and sort out all the paperwork themselves. It's incredibly straightforward. The dealer just subtracts the settlement amount from their offer. If your car is worth more than the remaining finance (positive equity), they’ll pay you the difference. If you owe more than it's worth (negative equity), you’ll need to pay them the shortfall to close the gap.

This approach completely removes the stress of finding a buyer and navigating that complex payment process. Yes, their offer will be lower than what you could get privately, but for many, the peace of mind and speed are worth the trade-off. However, if your car is a non-runner or has serious damage, a dealer will likely turn it away. In that situation, you might need to look into how to sell a salvage car successfully.

Private Sale vs. Dealer Sale Comparison

Still on the fence? Making the right choice depends on weighing up what matters most to you. This table breaks down the key differences when selling a car that's still on finance.

| Factor | Private Sale | Selling to a Dealer |

|---|---|---|

| Final Price | Typically higher, putting more money in your pocket. | Lower, based on a trade-in valuation. |

| Speed | Can take weeks or even months to find the right person. | Often done and dusted within 24-48 hours. |

| Effort & Admin | High. You do all the work—advertising, viewings, and payment. | Very low. The dealer handles all the finance and DVLA paperwork. |

| Transaction Security | Requires careful planning to ensure both you and the buyer are protected. | Extremely secure, with a tried-and-tested legal process. |

| Best For | Getting the maximum price, especially if you have the time to spare. | A guaranteed, fast, and completely hassle-free sale. |

Ultimately, take a look at your settlement figure, your car's market value, and your personal circumstances. If time is on your side and you’re confident managing the process, a private sale is hard to beat for returns. But if you need a quick, simple solution, a dealer offers an unbeatable level of security and convenience.

How to Handle the Transaction and Pay Off the Finance

You’ve got your settlement figure and a buyer ready to go. Now comes the most critical part of the whole process: the actual transaction. This is where things need to be handled with care to make sure the finance is cleared correctly and everyone walks away happy and legally protected.

Whether you're selling privately or to a dealer, the golden rule is the same: the finance must be paid off at the point of sale, not afterwards. This is an absolute must-do and protects both you and your buyer.

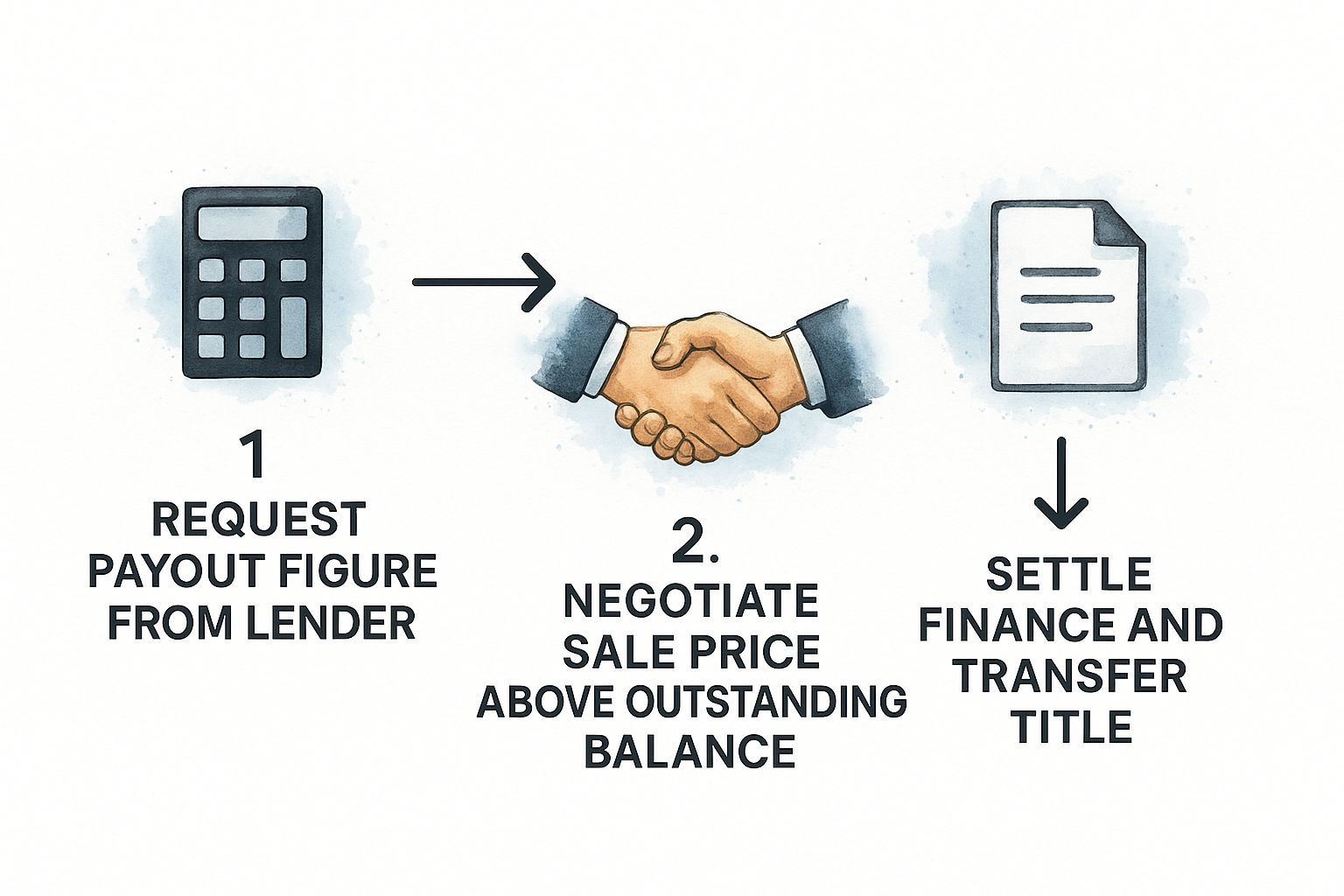

The process might seem a bit daunting, but it follows a clear path.

As you can see, it all flows from getting your settlement figure, to agreeing on a price with a buyer, and finally, settling the finance to officially transfer ownership. It’s a secure and straightforward sequence when handled correctly.

Managing a Private Sale Transaction

Selling privately means you have to build trust. Think about it from the buyer’s perspective—they’re about to hand over a lot of money for a car that technically still belongs to a finance company. Your job is to make the payment process completely transparent.

One of the best ways to do this is to get the lender involved directly in the sale.

- A Conference Call with the Lender: Get your buyer on a conference call with you and your finance provider. This way, they can hear you provide your details and clear the outstanding balance using their payment. It's a great way to offer immediate peace of mind.

- A Direct Bank Transfer: An even cleaner method is to have the buyer transfer the settlement amount directly to the finance company themselves. Just give them the reference number from your settlement letter. Any money left over from the sale price can then be transferred to your personal account.

This approach gives the buyer instant proof that the debt is gone. They see their money go exactly where it needs to, which completely removes any doubt or hesitation they might have.

Always draw up a simple seller's contract or a receipt for the sale. Make sure it includes the car's registration, the total sale price, the exact settlement figure paid, and the names and signatures of both you and the buyer. This piece of paper is a crucial trail for both of you.

How Dealerships Handle the Process

Things get much simpler when you sell to a dealership. They’ve seen this a thousand times and have a slick process for it. The dealer will just ask for your settlement letter, call your lender to double-check the figure, and then sort out the payment directly.

The money you get is simply the agreed price minus what’s owed. For example, if they offer you £15,000 for your car and your settlement figure is £13,200, they’ll pay the finance company £13,200 and send the remaining £1,800 straight to your bank account. Easy.

The Legal Importance of Clearing the Finance

Let's be clear: not clearing the finance properly is a huge legal risk. Under UK law, finance deals like Hire Purchase (HP) and Personal Contract Purchase (PCP) are secured against the car itself. According to the Financial Conduct Authority (FCA), the finance company is the legal owner right up until that final payment is made.

If you sell the car without clearing the debt, the lender has the legal right to repossess the vehicle from the new owner. This leaves your buyer without a car and out of pocket, and they will almost certainly come after you legally.

Remember, the condition of your car plays a big part in its value, which directly impacts your ability to clear the finance. If your vehicle is past its prime, you may need to look at other options. You can learn more by reading our guide on how to scrap your car for the best value in 2023.

Dealing with Negative Equity and Finalizing the Sale

One of the trickiest situations you can face when selling a car on finance is discovering you're in negative equity. It's a common snag, and it just means the settlement figure you owe is higher than what your car is actually worth today.

Let's say you owe your finance company £11,000, but the best offer you can get from a buyer is £9,500. That leaves a £1,500 shortfall you have to sort out before you can legally sell the car. It’s a frustrating spot to be in, but it’s definitely not a dead end.

Strategies for Managing a Shortfall

The most direct way to handle this is to pay the difference out of your own pocket. If you have the savings, covering that gap yourself means you can clear the finance completely when the sale happens. It's clean, simple, and often the fastest way forward, especially if the shortfall isn't too massive.

Another option, particularly if you're part-exchanging at a dealership, is to see if they'll roll the negative equity into the finance deal for your next car. This gets the old car sold, but tread carefully here. You’ll be paying interest on that old debt as part of your new car payments, which inflates the total cost over time.

Tackling negative equity head-on is non-negotiable. If you don't clear the full settlement figure, the debt remains tied to the car. That puts both you and the new owner in a very risky position.

The consequences of an unpaid balance can be severe. Figures on vehicle repossessions show the average debt left after a car is taken back can be anywhere from £9,000 to £10,000. This really drives home how vital it is to settle the finance properly and avoid a much bigger financial headache later on.

To get a clearer picture of how this single debt fits into your finances, it might be helpful to look into understanding your overall debt-to-asset ratio.

Finalizing the Paperwork for a Clean Break

Once the money is sorted and the finance is cleared, you're on the home stretch. But don't pop the champagne just yet—there are a few crucial bits of admin to tick off. These final steps are what officially release you from any legal responsibility for the car. If you skip them, you could be on the hook for future fines or penalties.

Here’s your final to-do list for a clean break:

-

Tell the DVLA—Straight Away: You are legally required to notify the DVLA that you've sold the vehicle. The quickest way is to use the online service on the GOV.UK website. You’ll need the 11-digit reference number from the car's V5C logbook.

-

Sort the V5C Logbook: Give the green 'new keeper' slip to the buyer. Once you’ve told the DVLA online, you should destroy the rest of the V5C document.

-

Get Written Confirmation: Never just assume the finance is settled. Ask your lender for a formal letter or email confirming the account is closed and the balance is zero. This document is your proof that the debt is officially cleared.

Ticking off these last few items guarantees a clean, legal transfer. It’s the final step to getting that peace of mind and knowing the sale is well and truly finished.

Common Questions About Selling a Financed Car

When you’re trying to sell a car that’s still on finance, a lot of “what if” questions tend to pop up. It’s completely normal. Getting straight answers is the best way to feel confident you’re doing everything by the book and avoiding any legal headaches. Let’s tackle some of the most common queries we hear from sellers in your shoes.

At its heart, the whole thing boils down to one simple fact: the finance agreement is a legal contract between you and the lender, with the car as the security. Trying to sidestep those terms is where the trouble starts for everyone.

Can I Sell a Car if the Finance Is in Someone Else's Name?

This is a hard no. The only person with the legal authority to deal with the loan is the person whose name is on the finance agreement. Simple as that.

They are the only one who can request a settlement figure from the lender and give the green light for the transaction. If you try to sell the car yourself, you’re stepping into fraudulent territory. You absolutely must work with the person named on the agreement to follow the correct process.

What Happens if I Sell Without Telling the Finance Company?

Honestly, this is the biggest mistake you can possibly make. Selling a car without paying off the loan is illegal, mainly because the finance company still technically owns the vehicle until every penny is paid back.

The fallout from doing this is serious and can get messy very quickly:

- Repossession: The lender has every right to find and repossess the car from its new, and probably very unhappy, owner.

- Legal Action: You can bet the buyer will take legal action against you to get their money back.

- The Debt Remains: Even if the car is gone, you are still legally on the hook for the entire outstanding loan balance.

- Criminal Charges: You could easily find yourself facing criminal charges for fraud. That’s a life-changing situation you want to avoid at all costs.

The key takeaway here is that being upfront isn't just good manners—it’s a legal requirement. The finance has to be cleared as part of the sale. It’s the only way to protect yourself, protect the buyer, and legally transfer ownership.

How Quickly Can I Get a Settlement Letter?

Most finance companies are pretty efficient with this. You can usually get a settlement figure instantly just by giving them a call or by logging into your online account.

The official settlement letter, which is the document you’ll need for the buyer, is typically emailed or posted out and should land with you in a few working days. Just keep in mind that the figure they give you has an expiry date—it’s usually valid for 14 to 28 days. You’ll need to time your sale to fall within that window, otherwise, you'll have to request a new one. For more answers to common queries, check out our detailed FAQ section.

Is a Car Buying Service an Easier Option?

For a lot of people, the answer is a definite yes. Using a trusted car-buying service is often the most straightforward and secure way to handle things. These companies do this day in and day out, so they have the process down to a fine art.

They'll contact your lender to verify the settlement figure and take care of all the admin. The outstanding finance is simply knocked off their final offer, and any money left over—your positive equity—is paid directly to you. You might not get the absolute top price you could in a private sale, but the lack of hassle and added security is often worth its weight in gold.

If your car is damaged, a non-runner, or simply at the end of its life, clearing the finance can feel even more challenging. Fast Scrap Car offers a simple, transparent solution. We provide a fair, competitive quote, handle the finance settlement for you, and offer free, same-day collection across London and Surrey. Get your instant quote today at https://fastscrapcar.co.uk.